As our captain and CEO, Scott Osborne puts it, “when we get to a place like this, not only do we look internally and ask if Total Synergy is able to respond and manage a crisis ourselves, we also need to do the same thing for our clients. And as a business, I think our purpose here is to help our customers, our clients, our community, through a very tough time.”

To that end, we want to talk you through whatever we know, and give you whatever we have, to help you look after your AEC business right now (at a distance, of course). Because we’re using this advice too.

If you’re a customer of ours, we’ll quickly show you where and how you can best use Synergy software to carry out these next steps. If you’re not a customer, that’s fine, the following still applies.

We sat down (virtually) with Deidre Ruddick. Not only is Deidre one of our best and brightest consulting assets, she is also a trained accountant who was the financial controller for one of our engineering clients during the global financial crisis (GFC). She saw them through, she’s seeing us through, and she’s here to see you through. Bless her cotton socks (from afar, of course).

Let Deidre show you what we need to do now.

“What I would do first is focus on striking the balance between the projects you’ve got, and the resources you have,” says Deidre. “You’ve got to have enough work for your people, and enough people for your work.

“Because of the uncertainty, because people have been restricted to working from home, there’s likely to be a limit to the projects on the books that will move forward. It’s likely several will go on hold.

“Some of the companies you’re working for will say, ‘Look, we don’t know. Maybe not this month’, which is almost worse than a cancellation because you can’t plan with that. If a project goes on hold for six months, you can plan around that. But when it’s, ‘Oh, we think’, and you think you’ve got work for your people and then, ‘Ah look, no, maybe next week, and maybe the week after,’ — that’s one really awful part of it.”

First step — review your pipeline

“First of all, you’ve got to look at the projects currently on your books. Be really objective about what you’ve got. If there is any doubt, you’re probably better off being conservative and saying, ‘Okay, that’s on hold’. Also look at your proposal pipeline, how much of that is likely to proceed and when.

“You’ve got to get a good feel for how much work you’ve actually got in your hand right now.

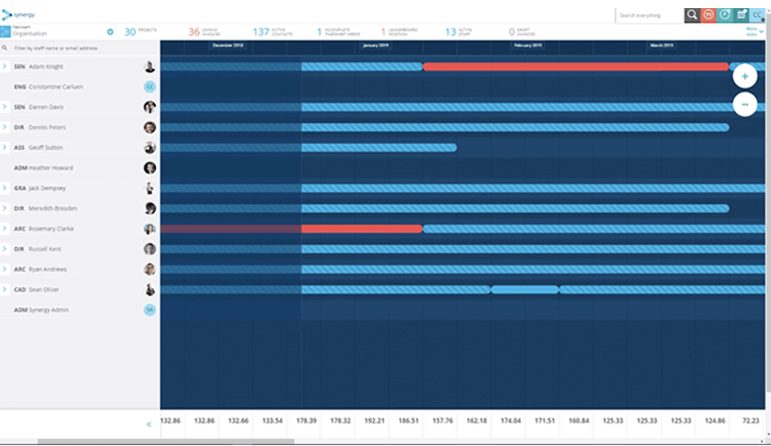

“If you’re a Synergy customer this means going to your company planning board in the app.

“Here you can check all the projects in your pipeline, both opportunities and active jobs. You have a weighted revenue forecast graph at the bottom of the screen, which gives you an immediate picture of the health of your business. Any proposals on the Synergy planning board are already weighted based on the likely success attached to the status you assigned.

“To achieve the same weighting for projects (at any stage), our product manager, Paul Hemmings, has a great methodology where you can add a custom field to a project (or stage) at this point, to indicate likelihood of going forward, run a forecast report and then download it into Excel.

“First you need to review the likelihood factor you have allocated to each of your opportunities of winning the work. I’m guessing they look a bit optimistic right now.

“Next you need to review the active projects and allocate a risk factor — how likely is it that this job might get cancelled. To do this, create a ’risk’ custom field for your projects, and dump it to Excel via a report.

“You can do some great ‘what-if’ analysis with this data, or even better pull it into Power BI for some really fancy business intelligence.

“If you’ve got questions about how to do that, you can get it from us, anytime, here.”

Second step — review your resources

“Next, you need to ask yourself, ‘which of my staff do I know are fully resourced? Which staff do I need to reassess how they are resourced?’ Check that staff’s availability has been updated with the cancellation of holidays, make sure it’s all reflected in your books.

“Again, it’s about being clear about what projects and what staff you’ve got, and then you’ve got to see how the two line up. ‘If I’ve got too many resources, how do I handle that?’

“But the biggest thing I think is, don’t procrastinate. Get in and do it now. Don’t cross your fingers and hope, because it’s not going to get any better. Not in the short term.

“I’ve been advising Synergy users to carry this out by going to the bottom of the planning board. There you can access a drop-down menu that tells you whether you’re under or over-capacity for each rate group you’ve got — the capacity planner on the planning board.”

Third step — evaluate your cashflow

Once you’ve worked out how much work and how many staff, Deidre says, “then you’ve got to look at your cashflow, right?”

Right.

“Look at your cashflow. Manage your cashflow. If you listen to the news, they’re saying clients should be talking to their landlords. If you can get a rebate on your rent, go and take that action. Make those phone calls.

“If you can reduce your outgoings, if you can reduce your rent, reduce your utilities, or at least defer them until things are better known. Look at government stimulus, talk to your accountants. Buy yourself some time.

“What discretionary expenditure can you cut? For us, not being in the office means there are no purchases like alcohol, fruit, milk, coffee. You know those things all help. But only to a point.

“Having said that, you’ve got to be incredibly careful about cutting the things that look after your staff. Don’t cut things that are going to cut morale, because we’re all in this together, and it’s so important for us to pull together — what’s going to get us out the other end is working together as a team.

“For Synergy users, this step is where you move into your accounting system. If you think about it, evaluate your cashflow, what are your expenses? That information is inside your connected accounting application.”

Fourth step — cut fast, cut deep, cut once

“Other sorts of things you can look at, if the amount of work has been seriously cut, is whether it’s an option to ask some staff to work a shorter week; to be able to try and save staff by asking everyone to take a little bit of a cut.

“Again, it’s solidarity, so people don’t feel like they’ve been singled out. It’s a terrible thing for employers to have to decide which employees go while others stay. I mean, that’s gut wrenching. But with any changes you are going to make, do them quickly and decisively. Give the staff you are taking forward confidence in the action plan.

“I’ve unfortunately been in that position. I’ve been on the other side and had to make those decisions. I know staff may not necessarily see it when they’re the ones getting cut, but employers really suffer through that stuff. They don’t want to do that.

“Synergy customers, once you’ve done the tough work, the first three steps, you’ve got to look at your overhead factor in the fourth, and again, that’s your accounting software. The next two steps are where you head back into Synergy to apply the information you’ve gained.”

Fifth step — recalculate your position

“Once you’ve looked at all the things you can cut or reduce, you can then recalculate how much work you need going through the books to break even.

“So, do that calculation. Do it now. If the business finance side is not your forte, get expert help. Because you’ve really got to deal with reality. Your actual numbers. In these times, you have to.

“For our software customers, you can carry out this calculation by using your financial controls settings within the app. If you need help with this, or anything else really, just reach out to us.”

Sixth step — actively manage your cash

Lastly, Deidre says, “be on top of your debtors, because you’ve got invoices out there. You’ve got to make sure that you’re calling people. Don’t be the one that that says, ‘Oh, well, they won’t have enough money. Why should I ask?’ — people do have some money and they will pay the squeaky wheel. Stay on it and be collecting your debtors to keep that cash moving as much as you can.

“For Synergy people, this a matter of running your report out of Synergy for debtors. It’s a standard report, but again, were here to help and advise if you need it.”

Landing

As we mentioned in the intro, Deidre knows what she’s talking about. Like her, and like you, we’re planning carefully and quickly for the uncertainty we face. There’s no way around it, but we will get through it.

“Unfortunately, I have to say, I have lived through this and I’ve had to do it,” says Deidre. “In the GFC, I was working in a consulting engineering business in Sydney, and the worst part is that it kind of comes in spurts — you think, ‘oh, we’ve won a project! You know, we’re actually looking good.’ And then it’ll go on hold. Heart up. Heart down. It’s a roller coaster. That’s what people will be going through. That’s what we’re all going through.

“More than anything we’re dealing with this terrible virus now, but almost certainly there’s going to be a recession on the back of it. How do we recover? How long will it take us to recover?”

And we’d add, what are the best ways forward to ensure that we can indeed recover? As quickly as possible.

From the bottom of our AEC business hearts, we hope you’re keeping well. Let us know what you need. Let us know how you’re coping. Let us know what you’re thinking. Let us see a picture of your dog. Let us let you laugh at our kids as you hear them mucking around in the background of our calls. Whatever works. Built environment buddy.