FEATURES

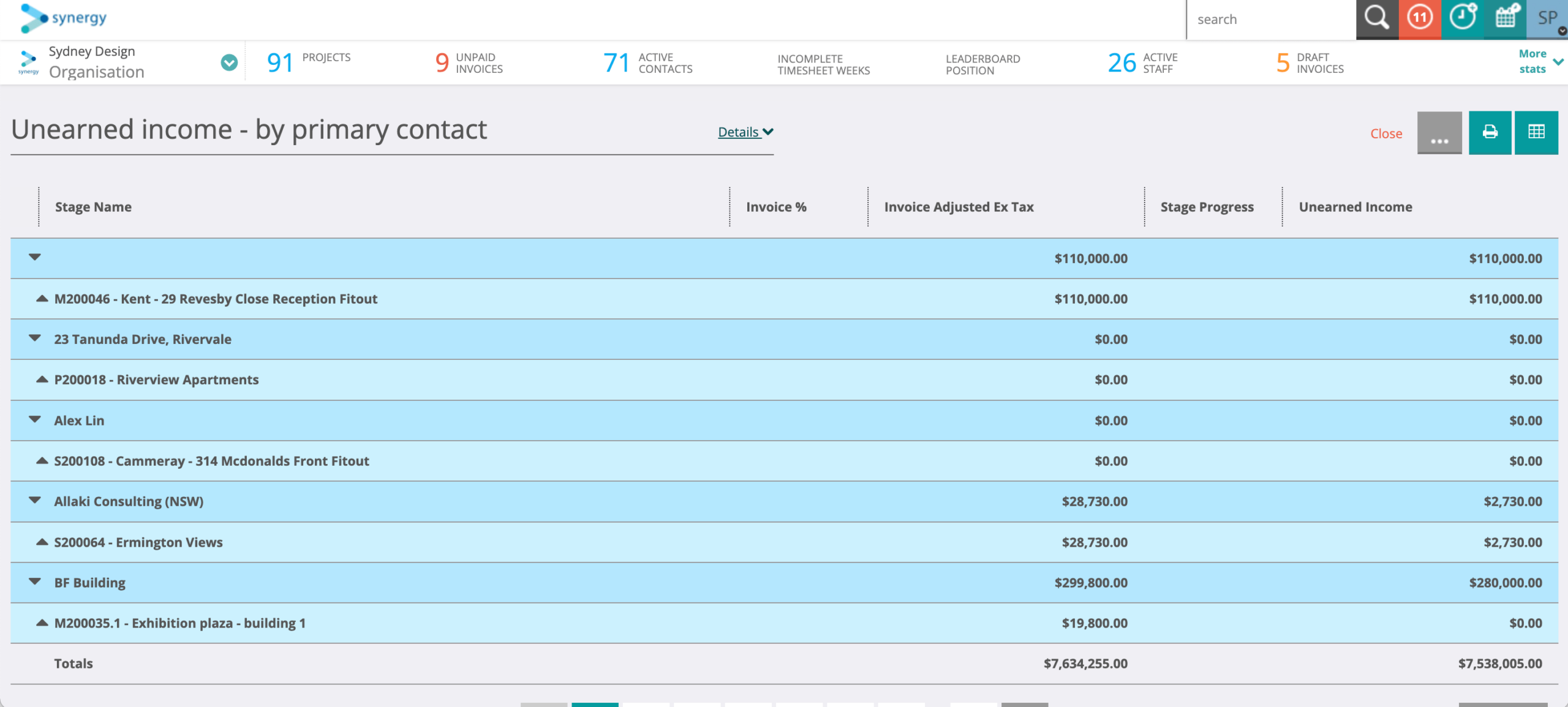

Unearned income

Easily see the money you've earned (revenue) versus the money you've received but haven't done the work for yet.

Synergy unearned income is an Enterprise feature that quickly and easily helps you discern money that should be moved into the revenue account from money that needs to remain in the liability account.